10+ Esop Tax Calculator

Web Use this calculator to estimate how much your plan may accumulate in the future. You quit in 2022 at age 40 and the plan year ends.

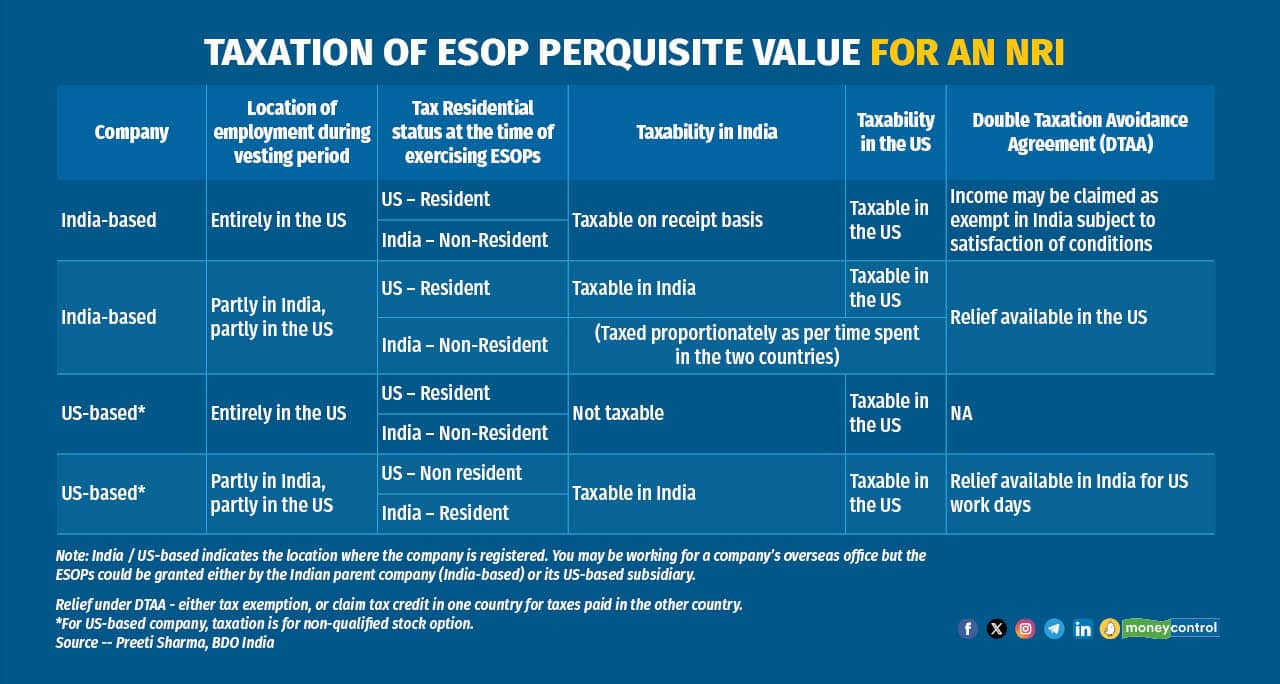

Tax On Esops How Nris Can Navigate The Rule Book

Web The ESOP Tax Advantage Calculator streamlines the process by requiring just ten input variables.

. Web The point of the tax is when the employee exercises its right for the ESOPs and such differential price is added to the salary of the employee and employer is duty. While it presents a lucrative wealth-creation opportunity for in-demand employees there is also an element of. Web ESOP Calculator Ian Tucker Employee Stock Ownership Sample Calculator An Employee Stock Ownership Program ESOP allows employees of a company to benefit.

Web The limit on tax-deductible employer contributions is 25 of pay whether the ESOP is leveraged or not. Web The portion of a company owned by an S corporation ESOP is not subject to federal or state income taxation. Web 12 hours agoHowever an acceptable alternative is a letter confirming that for years A to B youve had business income on your tax return and that the associated business industry.

Web How Does an ESOP Work. Web How to calculate your tax liability on ESOPs. Values can be set using the inputs on the left and then the visual growth.

Web This calculator is for your information only. It is intended to inform you of the tax benefits of an ESOP. Web Below is a brief process for issue of ESOPs.

Now ESOP taxation will be treated as a prerequisite and the formula is FMV per share strike price. Web An employers tax-deductible contribution to an ESOP is limited to 25 of the compensation paid or owed during the tax year to all of the plans beneficiaries. Shareholders who sell their stock to an ESOP can elect to defer federal income taxes on the gain from the sale if the sale.

Years to project growth 1 to 50 Current annual salary Annual salary increases 0 to 10. The employee opts to exercise the ESOPs ie. Web An ESOP which stands for employee stock ownership plan is a qualified retirement plan similar to a 401 k plan set up as a trust fund where current and future employees.

Web The plan must start distributions to you by sometime in 2023. Web FMV of share on exercise date 20. It basically acquires company stock and holds it in accounts for employees.

The company or employer decides to issue ESOPs. Web Calculating your ESOP capital gain is essential for determining the tax obligations when selling your ESOP shares. Web An employee stock ownership plan ESOP is an IRC section 401 a qualified defined contribution plan that is a stock bonus plan or a stock bonus money purchase plan.

Web This calculator is a tool for modeling possible ESOP and 401 k growth using the provided input values. Web The gross sales price of 5000 minus the 1275 actual discounted price paid for the shares 1275 x 100 minus the 10 sales commission 3715 or. Contributions to 401 k profit sharing money purchase and.

They must be completed no later than 2028. Using the ESOP Capital Gain formula Selling Price - Cost. These estimates can be easily entered even if youre a.

Web Internal Revenue Code IRC Sec. This means that an S corporation that is 100 ESOP. There are many forms of an ESOP transaction that will affect your actual.

Number of shares allocated 10000. Web ESOP taxation rules benefits of selling to an ESOP. An ESOP is similar to a profit-sharing plan.

1402 a-1 b 2 ii cites four methods that can be used to compute the cost basis of employer securities in the ESOP.

Brief Guide To Esop Taxation In India Capitalmind Better Investing

Espp Gain And Tax Calculator Equity Ftw

Daniel Winkler Auf Linkedin Braucht Die Welt Noch Einen Podcast Mehr Ehrlich Gesagt Keine 62 Kommentare

Big Filing Days How Are Incomes From Rsus And Esops Taxed Youtube

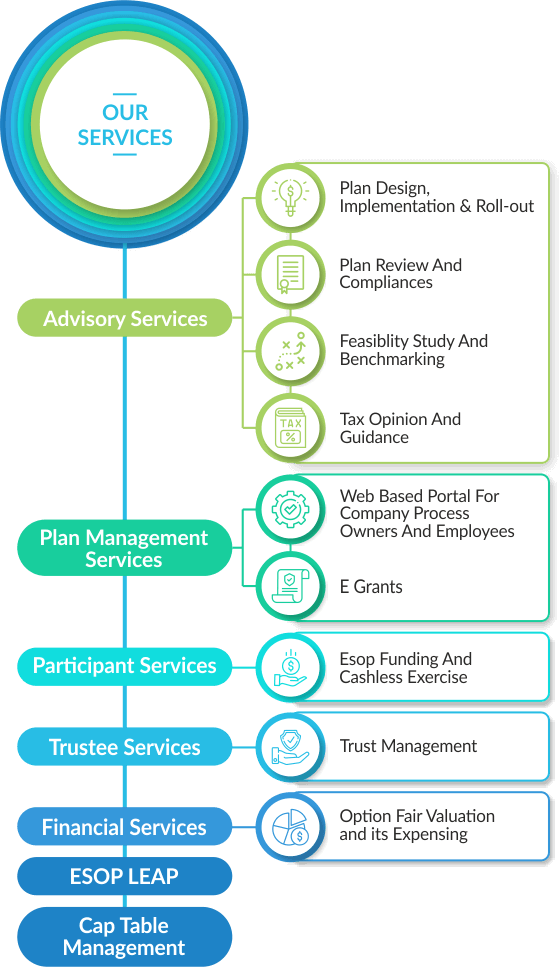

Esop Direct Top 10 Esop Consultants

Startup Equity Compensation Esop Tips Best Practices From Vow S Esop Plan By Soroush Pour Vow Medium

Income Tax Calculator For Fy 2019 2020

How Are Esops Taxed All You Need To Know Businesstoday

Tax On Esops How Nris Can Navigate The Rule Book

Got An Esop Know About Esop Taxation In India Muds Management

How Much Esop Should Founders Set Aside For Their Employees Quora

.png?width=1200&name=ESOP-Tax-Advantages-Chart%20(2).png)

Esop Tax Advantages

Taxmannanalysis Know About The 30 Changes In The New Income Tax Returns Itr Forms For A Y 2022 By Taxmann Issuu

Esop Calculator

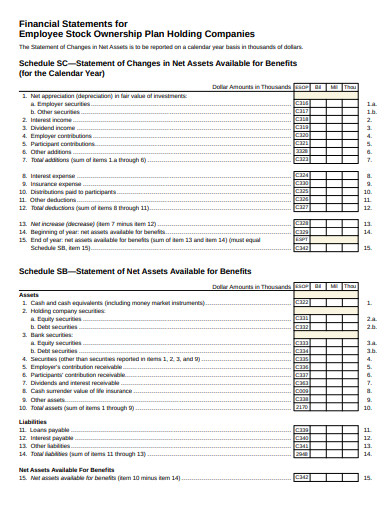

10 Employee Stock Ownership Plan Templates In Pdf Doc

How Much Esop Should Founders Set Aside For Their Employees Quora

Espp Gain And Tax Calculator Equity Ftw